Here we have a followup to an earlier post on my own macro website, newworldeconomics.com.

Bank Reserves and Basel III, 2021 #2: LCR and NSFR

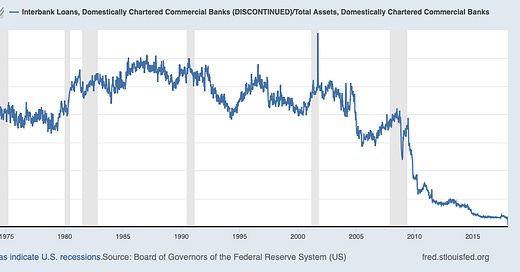

Basically, it confirms my view that US banks have pretty much topped up their need for Federal Reserve deposits (bank reserves), according to the Basel III accords. Further Federal Reserve monetary expansion beyond this point might have much more consequences than that of the past 13 years, since 2008. Also, I discuss the idea that the “Fed Funds interest rate target,” which was its main focus for many years, hasn’t really been a factor since 2009. Also, I think the experiment in Interest on Reserve Balances, 2016-2020, might not be repeated. This might be a nice thing: the Federal Reserve is out of the short-term interest rate manipulation game. If so, then expectations of “Fed rate hikes” in 2022 or later are off the table.

It seems that in recent days, the likelihood of Jerome Powell being replaced at the Fed is rising. About the only reason to do so would be to engage in an easier, more MMT-flavored policy. And hasn‘t Congress gotten away with it for over a decade now? I am not waving the dollar doom flag at least until USD/gold breaches $1910. But, a Powell replacement could definitely kick that off.