IGWT 2023, GMO on Profit Margins

Incrementum’s comprehensive annual information roundup regarding precious metals, the “In Gold We Trust” report, is out:

GMO comments on elevated profit margins. Valuations based on variants of price/sales have an inherent assumption of normalized, historical average profit margins — an assumption that has worked extremely well in the past. I think that profit margins may remain elevated in the future (9% vs. 6%), due to effective cartelization and other factors, but that they still have downside compared to recent very high levels (13%).

“The Curious Incident of the Elevated Profit Margins, Part I,” by James Montier (free registration may be required)

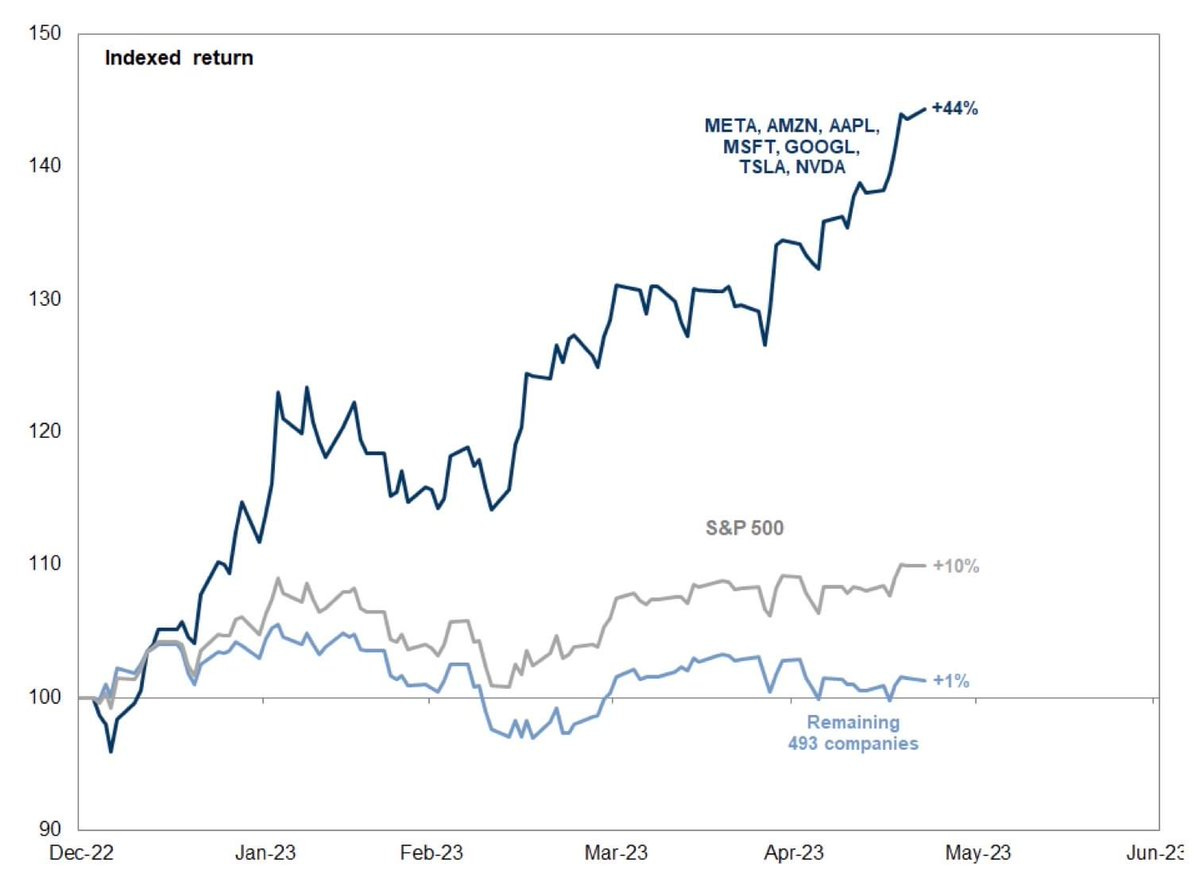

The recent SP500 strength is all due to seven bigcap tech names with an AI theme. The “S&P 493” is about flat YTD.

Traders have extreme bearish positioning in oil, a bullish sign.

The Treasury yield curve is still deeply inverted. This is likely to be resolved either by: The Fed cutting rates in response to recession; or the long end rising in response to the collapse of rate-cutting hopes. Both are negative for asset prices IMO.