Treasury Inflation-Protected Securities are paying their highest yields in about a decade, and not too far off their highs of 2006-2007. This is the “real” yield, to which is added an inflationary adjustment. So, if the CPI is +5% in the future, you get 5% plus about 1.5%, or 6.5%. This looks to me like one of the better deals in fixed income today. Although I think it is likely that the CPI (“inflation”) will decline going forward, I also think there is a risk that it could be much higher than 5% within a 10yr timeframe.

Naturally, this has left the iShares TIPS Bond ETF (TIP) around its lowest price since 2011.

This translates into “breakeven rates,” implied by the difference between the TIPS “real” yield and the yield on regular Treasury bonds.

This is now about 2.30%. In other words, if the CPI in the future is above 2.3%, you are better off in TIPS. If the CPI in the future is below 2.3%, you would be better off in regular Treasury bonds. But, there is a good possibility that such a condition (CPI<2.3%) would amount to a "deflationary hard landing,” where bonds would soar; or, a very easy Fed, leading to more inflation later. For example, in a “deflationary hard landing,” maybe the 10yr rate would go to 1.5% and the breakeven rate would be 1%. That implies a TIPS real yield of 0.5%, which would be a nice gain. Not a lot of downside here, and multiple ways to win.

Flight To US Assets

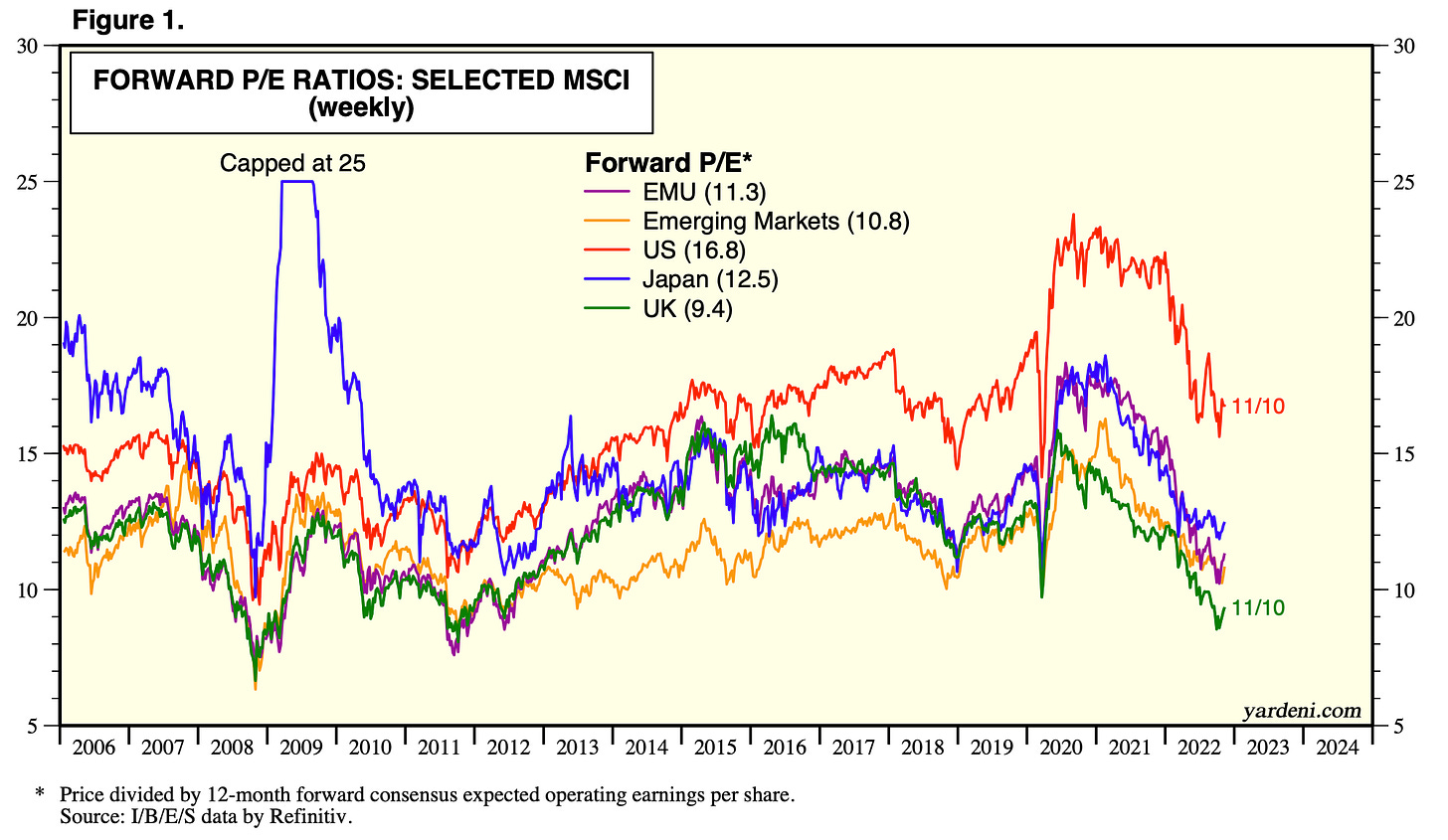

We’re seeing the expected patterns of a flight to US assets, by international capital. As dismal as things are in the US, they are worse elsewhere. This expresses itself in the absolutely gigantic spreads in valuation now between US stocks and elsewhere.

Nevertheless, US outperformance continues.

The expected pattern is an embrace of bigcap “blue chips” by international investors, who are moving huge amounts of money, and who are not picking stocks in the Russell 2000. Indeed, the relative valuation of the midcap SP400 or smallcap SP600, compared to the bigcap SP500, has hit rock bottom.

The performance of the extra-bluechippy DJIA has been particularly impressive, in the midst of a bear market.

The flight to US assets is well-justified, in my view, and we will probably continue to see its footprints going forward.